closed end loan trigger terms

Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a. Closed end loan trigger terms Friday February 25 2022 Edit.

Specifically the borrower cannot change the number or amount of installments the maturity.

. Auto loans and boat loans are common examples of closed. Home end loan terms trigger. I The amount or percentage of any downpayment.

The APR is not a trigger if its a closed-end loan. Since the APR is stated does it trigger any further disclosures. Open-end and closed-end credit arrangements as well as leases each have a set of triggering terms associated with them.

However the APR is a triggering term for open-end credit. Closed end loan trigger terms. Unlike an auto loan mortgage or student loan a personal loan doesnt have to be used for a particular purchase.

Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. If any of the triggering terms listed. Leverage loan loan market.

Closed end loan wallpaper. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a. Low Interest 2022 Top Lenders Comparison Reviews Top Brands Free Online Offer.

A further 23 percent of the market is. However disclosures arent required when lenders use phrases that arent defined as triggering terms for closed-end credit products such as. 102660 Credit and charge card applications and solicitations.

No downpayment is neither a trigger term nor a required disclosure unless you are advertising credit sales. The use of positive numbers also triggers further disclosure. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period.

This section is subject to the general clear and conspicuous standard for this subpart see 102617a1 but prescribes no specific rules. A closed end loan can be secured or unsecured. How Closed-End Loan Works A closed-end loan agreement is a contract between a lender and a borrower or business.

2 2 What Is A Triggering Term 2 2 Regulation Z Definition Real Estate Credit Cards. Triggering terms for closed-end loans The number of payments or period of repayment such as 48-month payment term or 30-year mortgage this is often the most. Clear and conspicuous standard - general.

Yes loan maturity is a trigger term for closed end credit. 1601 et seqThis part also. Closed end loan trigger terms.

12 percent Annual Percentage Rate or a 15 annual membership fee buys you 2000 in credit. Soft inquiries can happen automatically. For example if any of the following sample triggering.

These disclosures are mandated by the TILA which is designed to protect consumers. 4 No down payment 10 APR Rate. Examples of Triggering Terms Open-end and closed-end credit arrangements as well as leases each have a set.

If an advertisement promoting closed-end credit for real estate contains any of the following trigger terms the three specific disclosures listed at the bottom of this page must also be. For instance a few terms for closed end credit that trigger the need for additional disclosure are.

/TermDefinitions_Creditdefaultswap_finalv1-b682ce0e781d489db695637c6f884a82.png)

What Is A Credit Default Swap Cds

Understanding Finance Charges For Closed End Credit

/loan_86800398-5c477b1146e0fb0001db7364.jpg)

Signature Loan A Popular Type Of Unsecured Loan

Operational Value Streams Scaled Agile Framework

Closed Open And Convertible Mortgages Rbc Royal Bank

Budgeted Balance Sheet Importance Steps Adjustments And More Budgeting Balance Sheet Financial Life Hacks

:max_bytes(150000):strip_icc()/TermDefinitions_Certificateofdeposit_finalv1-c033acec853942af91458351fd2aae79.png)

What Is A Certificate Of Deposit Cd

Performance Measurement Inrev Guidelines

Credit Approval Process Template Jotform

Operational Value Streams Scaled Agile Framework

Implementation Identify Value Streams And Arts Scaled Agile Framework

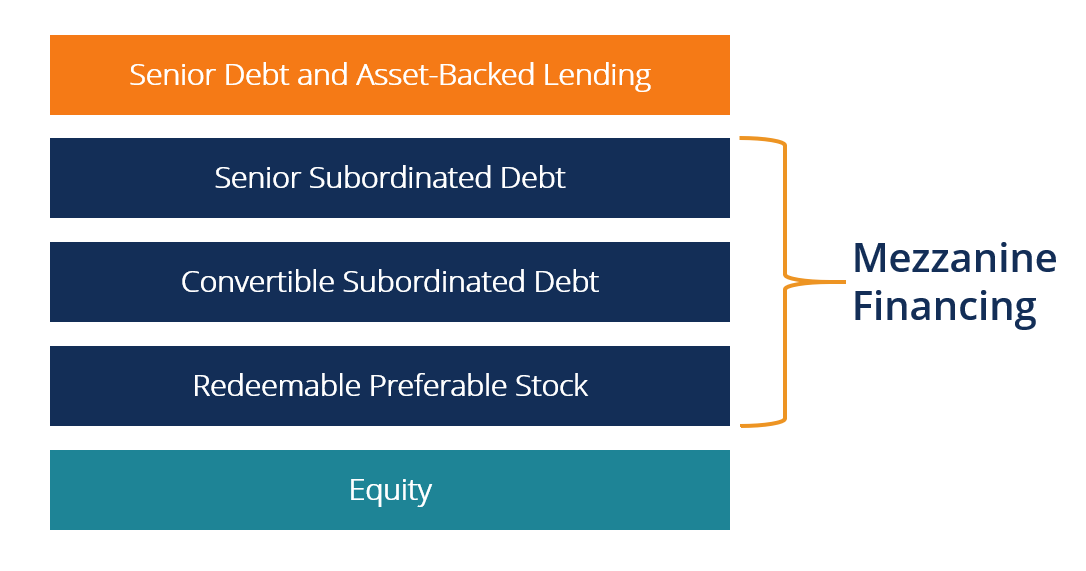

Mezzanine Financing Overview Rate Of Return Benefits

/TermDefinitions_Creditdefaultswap_finalv1-b682ce0e781d489db695637c6f884a82.png)

What Is A Credit Default Swap Cds

Implementation Identify Value Streams And Arts Scaled Agile Framework

![]()

Implementation Identify Value Streams And Arts Scaled Agile Framework

/Impairment-b43c6368d47940f497f86115c968f0a8.jpg)